Last week, I reviewed an estate plan that looked like someone used legal copy-paste: two identical leather-bound binders, two identical wills, two identical trusts. His fourth marriage, her second - you'd think they'd learned something about coordination by now. Instead, they're planning like roommates who happen to share a bedroom. Total cost? Probably $8,000-$10,000 for what amounts to expensive legal redundancy.

Beautiful presentation, terrible engineering. They got the legal equivalent of a luxury car with square wheels - it looks impressive in the driveway, but good luck getting anywhere together. Those leather binders will look great on the shelf. Right next to the divorce decree from their next failed attempt at partnership.

Look, I really, really don't want them to get divorced. Having watched my parents navigate three divorces between them, I know how much damage poor coordination can do to families. But when your lawyer designs an estate plan that treats you like legal strangers, they're not exactly setting you up for success as partners.

This expensive mess illustrates the most common misconception about estate planning: that choosing between wills and trusts is an either-or decision. Wrong problem. The real question is: what are you actually trying to solve?

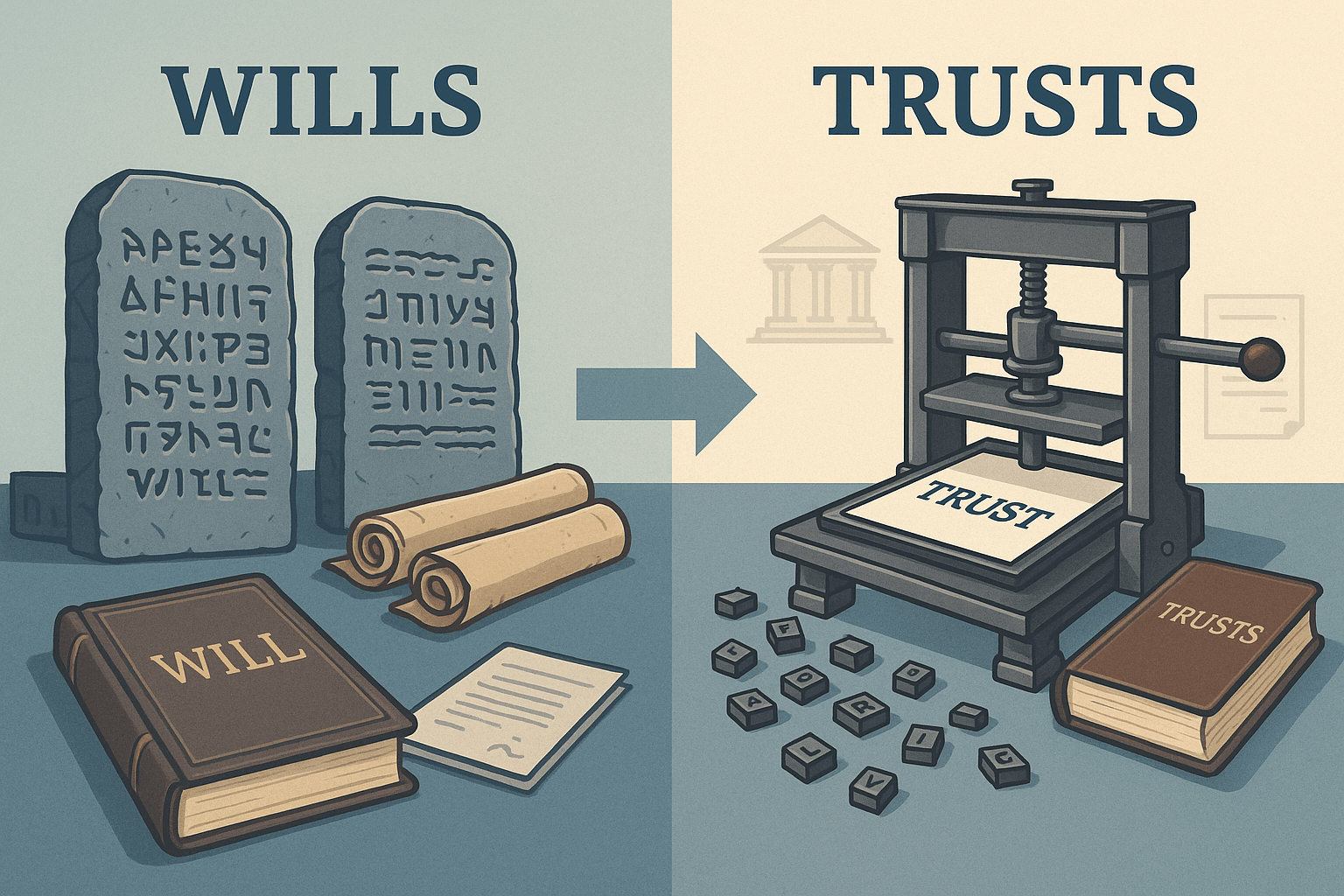

Stone Tools vs. Printing Presses

Wills are humanity's first legal technology, like stone tools for your estate. The law of wills is thousands of years old - crude but effective, with rigid formalities because they're ancient tech. You need witnesses, notaries, and probate court because wills predate modern verification systems.

Trusts came later - hundreds, not thousands of years old. Think of upgrading from chiseling on stone tablets to using a printing press with movable type. Trusts evolved when legal systems were sophisticated enough to handle more complex arrangements without all the ancient ceremonial requirements.

Here's the practical difference: wills are like pouring a concrete foundation. Once it's set, that's your plan. Trusts are like building with an engineering kit - modular pieces you can rearrange as life changes, just like those movable type pieces that made the printing press so revolutionary.

"But Isn't a Trust More Expensive?"

Here's the question I get every week: "Aren't trusts more expensive?" Yes. Trucks are more expensive than compact sedans too. If you're in construction, you need a truck. You don't have to buy a King Ranch $100,000 Ford F150, but you do need a truck.

Same with estate planning. If you're coordinating assets for a couple, managing privacy concerns, or want to avoid probate court, you need trust-level tools. I can build you a basic work truck or a luxury model - that's up to you and your budget. But don't let someone sell you a sedan when your life requires a truck.

Why You Need Both: The SIM Card Principle

Here's where most people get confused: "Why do I need a will if I've chosen a trust-based plan?"

It's not smartphone OR SIM card - it's smartphone WITH SIM card. The pour-over will isn't backup technology, it's essential infrastructure. Your trust handles 95% of your assets, but that pour-over will is the legal pathway that ensures anything we missed (or anything you acquire right before you die) flows into your trust system.

Think of your trust as the house, and the pour-over will as the driveway. You wouldn't build a beautiful house and forget to connect it to the street. The pour-over will is that connection - it's not a second house, it's the required infrastructure that makes the main house work properly.

Skip the Courthouse

Here's something most people don't realize: when you die, your estate has to go through probate court - whether you have a will or not. It's like getting a building inspection before your family can move in. This process is public, slow, and expensive. Anyone can look up what you owned, who you owed, and who got what. It's like posting your family's financial details on Facebook.

The trick with trusts? There's nothing in your estate to probate. Everything is owned by the trust, which hands over the keys immediately, no inspection required. Transfers happen immediately and privately. Family business stays in the family.

One Account vs. Two Safety Deposit Boxes

Here's another ancient limitation: you can't have a joint will. Wills are like individual user accounts - the ancient legal system couldn't handle shared logins. One will, one person, period.

Trusts evolved when legal "operating systems" got sophisticated enough to handle joint accounts with different permission levels. Both spouses can access it, make decisions, and coordinate their plans in one place.

Some lawyers will offer to write "matching wills" for couples. That's like buying two separate Netflix accounts instead of one family plan - you're paying twice, and when one person adds a show to their watchlist, the other has no idea what's new. Sure, it works, but you're paying twice for less coordination.

Function Over Form

Whether you need stone tools or an engineering kit depends on what you're building and who you're building it with. From the outhouse to the penthouse, the right plan coordinates instead of duplicates, functions instead of just looking fancy.

Trusts bring lots of other feature options too - lifetime flexibility, tax planning opportunities, strategies to protect from creditors and predators - that we can talk about in our free Life and Legacy Education session. Because the best legal technology is the kind that actually works for your life.

We'd rather give you one well-designed plan that actually works than two gorgeous plans that work against each other. Function over form, coordination over decoration.

Ready to build something that actually works? Schedule your free Life and Legacy Education session and let's design a plan that coordinates instead of duplicates.